That document there on the right?

That document there on the right?

That’s the document that makes the legal industry seem archaic. It’s the one that makes CEOs think of their law departments as incorrigible cost centers. It’s the one that makes lawyers feel defensive.

If you’re an M&A lawyer, or a deal professional, it won’t be your first viewing of this species. It’s a standard law firm M&A diligence memo. They’re produced by the thousands every year.

A handful of junior associates on the outside deal team read through many of the key contracts of the target in the deal, and summarize key findings in this memo that contains tens of thousands of words, for the benefit of the buyer. In the typical case, these memos get produced by lawyers billing hundreds of dollars an hour, at a total cost that can quickly sum to hundreds of thousands, if not millions of dollars.

The problem with this approach is not so much the cost, it’s that it has almost no utility to the business or downstream stakeholders on the hook for integration. How could it? They’ll probably never read it. This diligence is seen as a necessity, and in fact it is, but the information in the memo is inaccessible for the same reason it was inaccessible in the contracts themselves: too long, too hard to interpret. Whatever insight might reside in these lines, no one has the time to liberate it. It is a deadweight loss.

Let’s call this M&A Contracts Past, although for too many companies today, this is still the present.

Contracts Future: Understand Contracts Without Reading Them

So what does the future look like?

It looks better. Not too long from now, all of the active contracts in a company’s corpus will be digitized and translated into structured data. Instead of being disguised in impenetrable legalese, locked into scanned PDFs and then, often, misplaced entirely, contracts will become a source of incredibly valuable data for the enterprises that enter into them.

With a couple of keystrokes, we will know the answers to all the one-off questions that cause a bit of internal panic for in-house counsel today. The day-to-day inquiries like, “In our deal with Supplier X in Poland, who owns the IP?”, or “Weren’t we supposed to get paid extra by Customer Y when we delivered a month early?” That’s going to lower the blood pressure of in-house counsel worldwide, and save countless hours of wasted cycles.

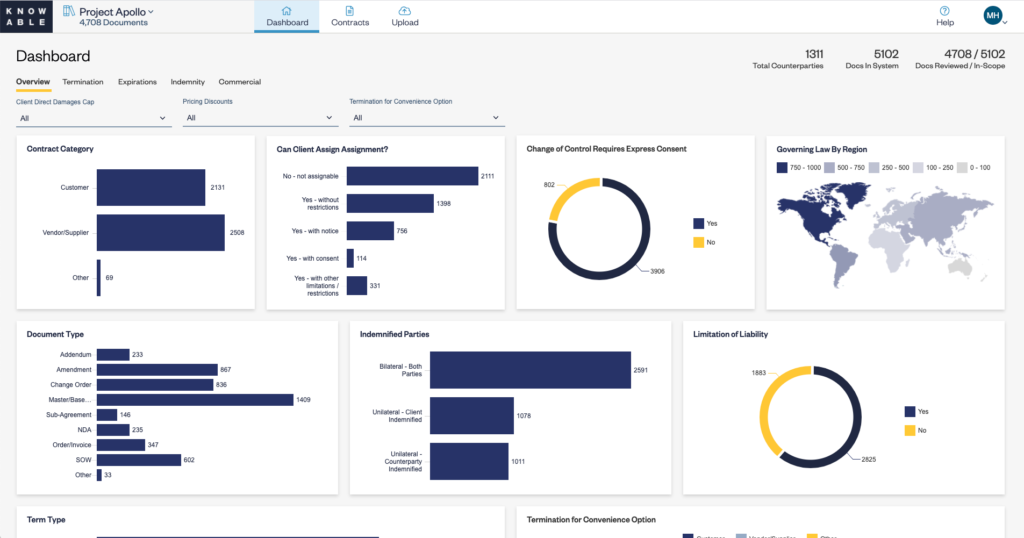

More important, we will also know, with a few more keystrokes, the answers to much more profound questions, questions that require a portfolio-level view. Questions like “When LIBOR goes away, which of our business relationships will be affected?” or “Which of our customer contracts that are generating more than 10 million dollars per year have an MFN clause and which are up for renewal within the next two quarters?”, or even “Which of our supplier contracts are out of compliance with our new data privacy policy?”

Think about it: If today, we can’t do portfolio-level contract risk management but can only identify and manage risk of one contract and one counterparty relationship at a time, does that really qualify as risk management?

I asked Mary Schapiro, the former chair or the U.S. Securities and Exchange Commission and board director of my former company (Axiom) how a regulator might view this deficiency in the current system. She replied: “When it’s possible to generate the kind of aggregated view of risk you’re describing, it would border on negligence not to do it.”

Returning to the narrower example of an M&A transaction, the seller will already know, before the deal is even under discussion, which contracts have change of control or assignability provisions that require attention, and, once the buyer is identified, which commercial arrangements promise actual (not imaginary) cost and revenue synergies in a combination.

That’s the future, and it’s going to be a lot more fun. And once we’re there, call it five years from now, we will look back in utter disbelief that as recently as today, we didn’t know what was in our contracts, or often where to find them. It will be just like wondering how we used to get around without GPS.

The Present: Starting the Journey From Here to There

Getting there is hard because translating contracts prose into structured data is complex and time-consuming. Even a relatively standard clause, say one on assignment, can be a hundred or more words, written in the special style of a particular lawyer or company, and a long way from clear.

To make things worse, the world hasn’t yet settled on a consensus of what positions are even possible in an assignment clause. Are there five different possible positions (including “other”), or 15? You can’t convert a contract clause to a data element without knowing the “pick list” of possible positions.

Solving for these kinds of challenges, across dozens of clauses in every contract, and across tens or even hundreds of thousands of active contracts in an enterprise… that’s a big job. And for the most part today, while machine learning is starting to assist, it still has to be done with old-fashioned wetware: actual humans.

But the game is worth the skin. Contract data promises many millions, even billions of dollars of real, EBITDA-style value to the enterprise that can harness it. Enforcing entitlements, understanding obligations, fine-tuning revenue recognition, being front-footed in compliance, responding efficiently to regulatory inquiries—these data assets are the sword in the stone for the general counsel. It’s what enables her, for maybe the first time, to transform the law department from a cost center to a generator of business value. We’re seeing this in a handful of companies today, Dell being a singular example.

“Through advances in artificial intelligence and other emerging technologies, we’re now able to categorize, analyze, and better utilize contractual information in a way that seemed impossible only a few years ago. Our ability to convert massive amounts of contract data into actionable intelligence is used to enhance our support of customers and increase the ease of doing business with Dell.” —Rich Rothberg, General Counsel at Dell Technologies.

Which brings us back, for the last time, to M&A. M&A is an ideal on-ramp for the larger journey to structured contract data. It is a unique trigger because it brings together time pressure, available budget, and a need for insight into existing contracts.

Buyers and sellers alike have no choice but to gather the target company’s contracts and diligence them, even if, as in most cases today, the output is an impenetrable spreadsheet. Recently, more and more companies are taking a structured data approach to M&A contracts diligence, and that approach has quantum advantages.

First, it is simply a better solution to the M&A diligence problem, in that it is cheaper, faster, and, most important, it delivers an interrogable data asset that provides real insights featuring very cool graphs and charts. And everyone loves graphs and charts.

More important, the need for analysis triggered by an M&A event is a first step in the contract intelligence journey. M&A contract intelligence shows the power of contract data in a subset of the overall contracts corpus. Once stakeholders have access to it—whether they be in-house counsel who can now answer one-off questions, or front office personnel who can get endless views into their biggest customers, renewal cycles, aberrant sales contracts and the like, or financial types looking for rev rec improvement, or operators seeking to understand their SLA obligations—the motivation to unlock the broader corpus takes root.

From there, companies like Dell are essentially turning the lights on department by department, stakeholder by stakeholder, like a rural electrification program.

That process has to start somewhere. It’s a big undertaking to find budget for as an abstract concept, except in rare circumstances, but it’s hard to return to kerosene once you’ve experienced life on the grid. Your next M&A deal can be your Thomas Edison moment.

This evolution is inevitable. It will happen over the next five or so years in most well-managed, global companies. And M&A diligence, which is a pain and a waste of resources today, is the secret portal.

– – –

Mark Harris is CEO of Knowable.