Data. Found.

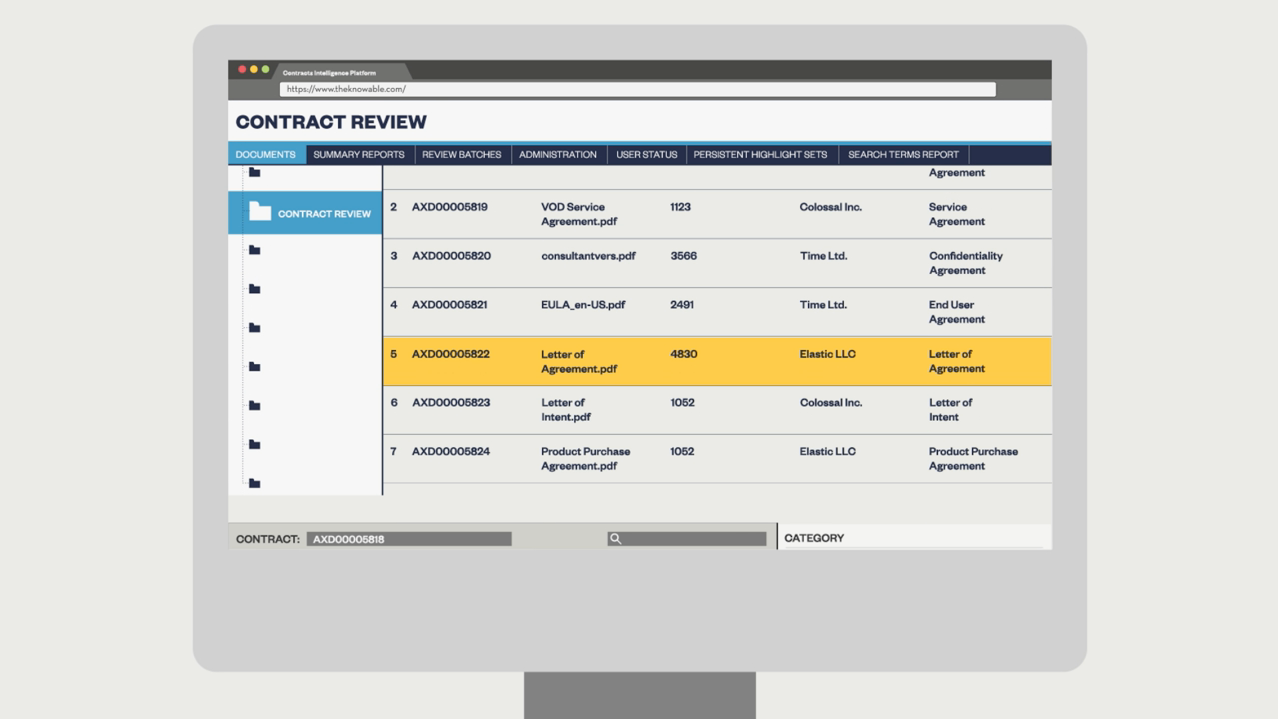

Modern business runs on data – a source of power that has long been out of reach for M&A diligence and integration teams. Knowable’s platform transforms archaic legal language into structured data, providing portfolio-level views of contract risks, obligations, and entitlements.

Fast and accurate.

Knowable delivers impeccable accuracy with AI, machine learning, and tech-assisted human expertise purpose-built for precision answers, delivered on time.

Big breakthroughs.

Create a single, golden source of structured data that can be mined for valuable reporting and analytics across the entire portfolio of agreements.

Game changer.

Contract data is accessible to cross-functional teams, equipping them with powerful M&A contract analytics and actionable insights to inform integration decisions.

Say goodbye to the traditional diligence memo.

Modern digital diligence can accelerate deal velocity and encourage higher bids.

- Keystroke, portfolio-level identification of important obligations and risks within the Target, or owned Asset for sale

- Confident understanding of ability to easily transfer the asset

- Comprehensive insight into highest dollar customer and vendor relationships

- Granular view of synergy potential from shared customer and vendor relationships, down to the level of contrasting agreement terms

- Instant analysis of target company’s compliance and regulatory vulnerabilities

- Easily share data cross-functionally and externally with approved deal stakeholders

Stop reading. Start Analyzing.

Whether your organization is on the buy-side, sell-side, or is part of a spinoff or reorganization, Knowable’s Due Diligence and Post Merger Integration platform helps teams make better decisions, much faster with:

- Insightful deal dashboards

- Robust analysis tools

- Visibility into decision-driving clauses

- Comprehensive search functionality

- 1 click access and download of all contracts

- 1 click data export to Excel

- Structured data easily ported to enterprise systems