Focusing on what matters.

Today, law departments manage legal risk at the individual contract level, spending millions of dollars trying to negotiate favorable agreements with each single counterparty that limit liability, protect IP and ensure compliance. Necessary, but not sufficient.

It turns out that a modern company’s material risks aren’t individual, they’re systemic.

That means what matters most isn’t the term you get with one customer. What matters is where you have weaknesses or exposures across whole populations of agreements, or business units, or regions.

Enter data-driven, portfolio risk management.

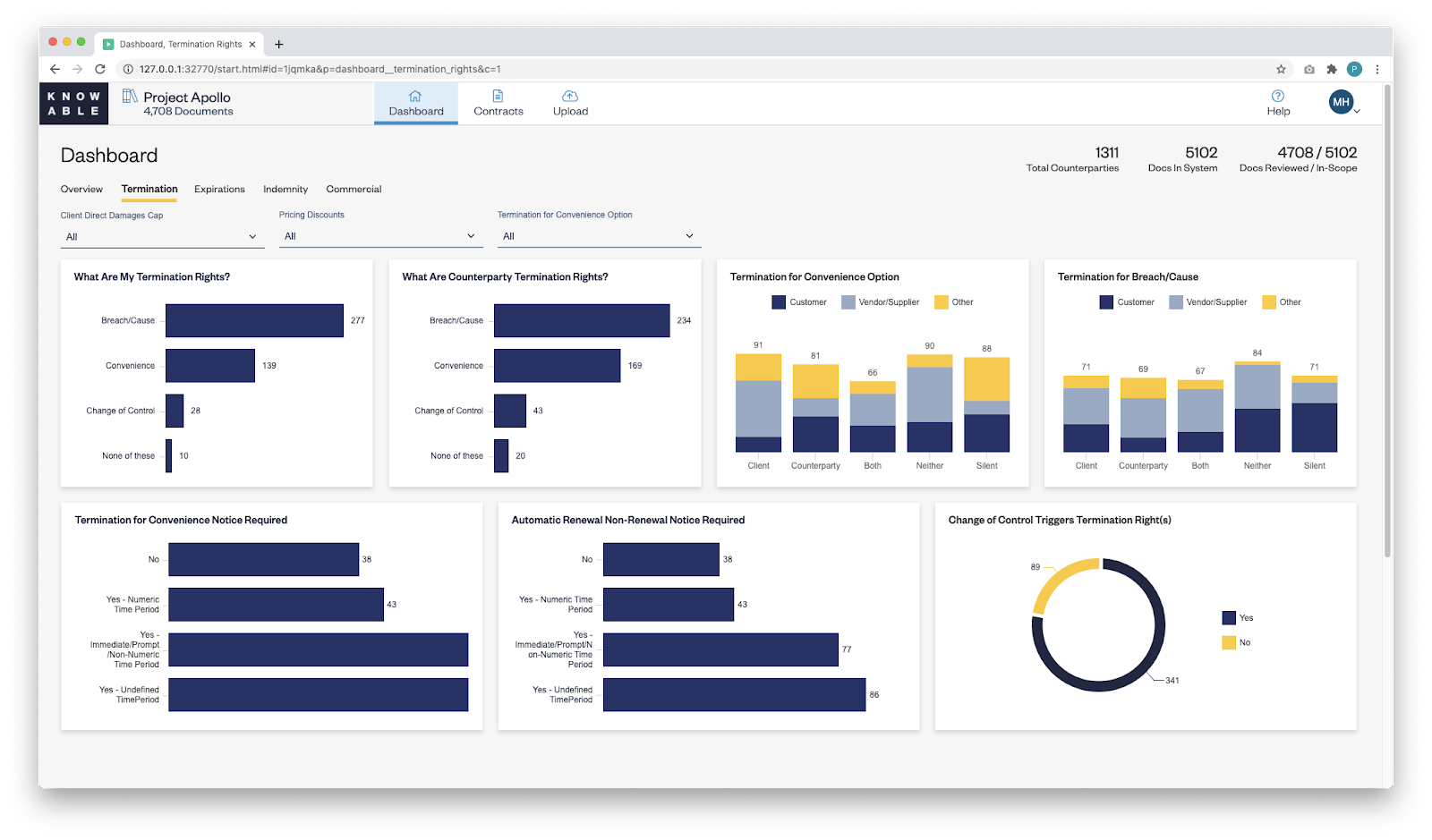

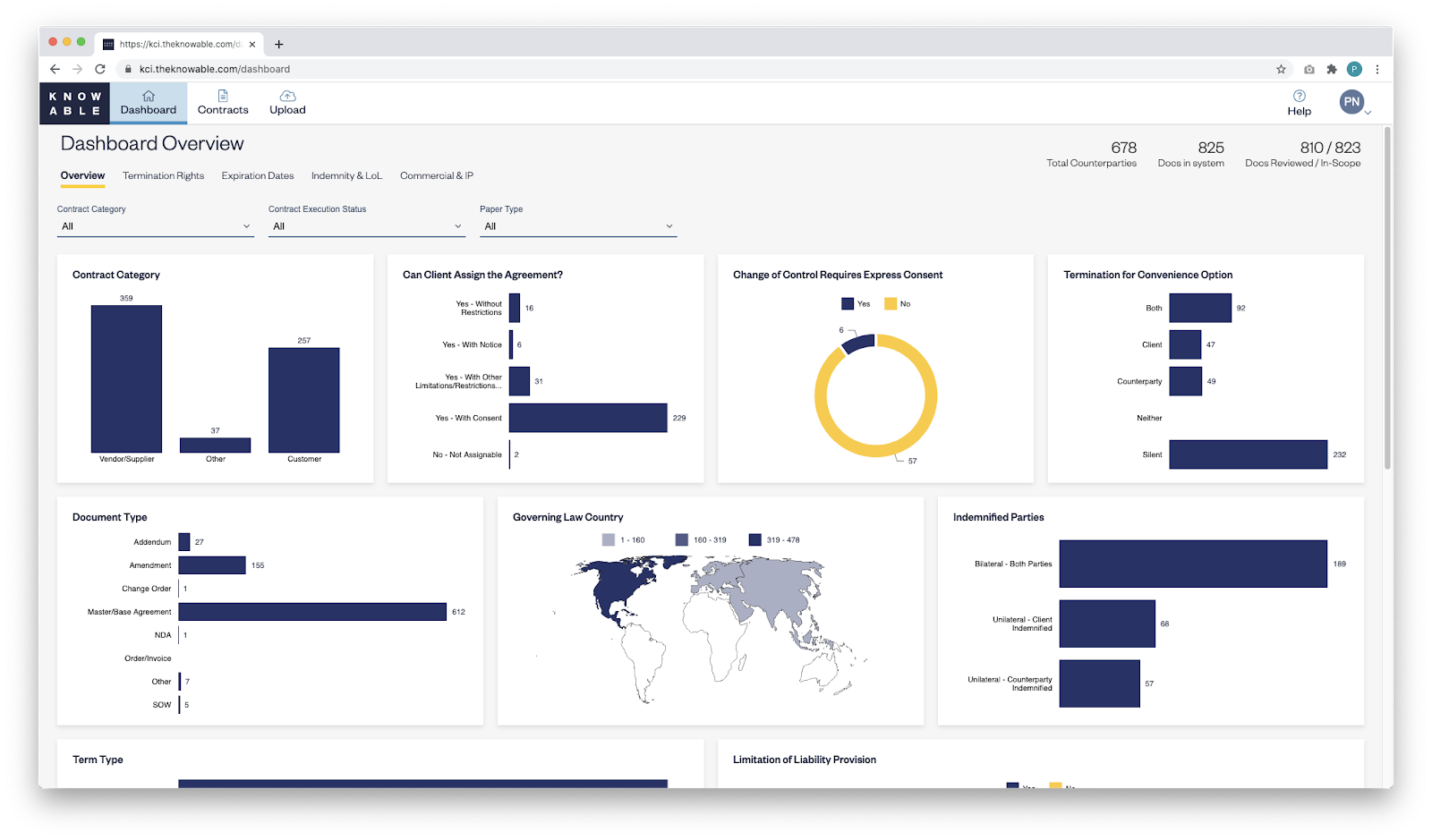

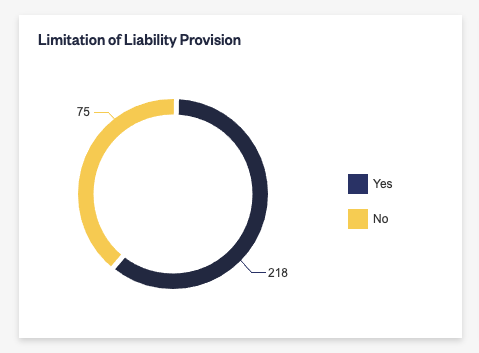

Managing material risks requires a portfolio view of contracts. It requires answers to questions like:

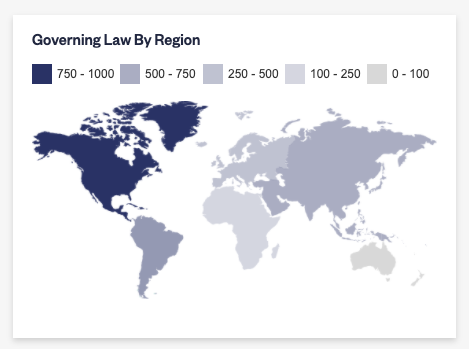

- Where do we have uncapped liabilities? Are those agreements concentrated in a unit or region? What are our rights to terminate or renegotiate?

- If we experience supply chain disruption, where will we face penalties or terminations in our customer base?

- Which contracts require renegotiation based on new data privacy regulations?

These questions take a portfolio risk management perspective that is out of reach for most companies today, because their contract data is locked in text, and a portfolio view requires structured contract data.

Data-driven risk management is the next generation of legal leadership in the enterprise. As former SEC and FINRA Chair Mary Schapiro put it, “When it’s possible to generate an aggregated view of risk, it will border on negligence not to do it.”

The era has arrived. Modern risk management starts with surfacing contract data to enable portfolio analysis.